carried interest tax reform

The carried interest loophole allows private equity barons to claim large parts of their compensation for services as investment gains. Carried Interest and Other Tax Reform Highlights for Investment Funds and Asset Managers.

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

Some view this tax preference as an unfair market-distorting loophole.

. It would reduce investment and savings while damaging the economy and Americas economic growth prospects. All of these types of investment firms have been accused of victimizing the public evading their tax obligations and benefitting from a preferential tax treatment. Proceeds from that individuals partnership interest are often taxed as capital gain rather than ordinary income.

Since then at least four presidential candidates have called for carried interest to be taxed at ordinary rates. A report by the accounting firm KPMG on the American Jobs and Closing Tax Loopholes Act which passed the Democratic-controlled House in 2010 and applied tax treatment to carried interest similar to the Biden plan found that the bill could apply to partnerships in virtually any kind of business and could fundamentally change how partnerships are taxed. This same loophole also fuels other predatory investing strategies that originate with private equity and real estate developers.

Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax. In 2014 Ways and Means Committee Chairman Dave Camp introduced a tax reform bill that would have raised rates on carried interest to 35 percent. The WM Proposal includes increases to the top individual and corporate rates including a five percentage point increase in the rate applicable to long-term capital gains and qualified dividends.

NMHCNAA believe that carried interest should be treated as a long-term capital gain if the underlying asset is held for at least one year. Carried Interest Reform Under the Bill the concept of an applicable partnership interest API would be introduced in the Code which is generally intended to capture the profits interest aka carried interest held by the sponsors of private equity hedge venture capital and other investment funds that are structured as flow-through entities. Senators Tammy Baldwin D-WI Joe Manchin D-WV and Sherrod Brown D-OH today introduced tax reform legislation to close the carried interest tax loophole that benefits wealthy money managers on Wall Street.

Debates about carried interest tend to take on a slightly hyperbolic character. This new code section is targeted toward managers in the private equity and hedge fund industry who in exchange for services often receive a percentage of a funds future profits the so-called carried interest or profits interest. The current tax treatment of carried interest is the result of the intersection of several parts of the Internal Revenue Code IRCrelating to partnerships capital gains qualified dividends and property transferred for services provided.

The key change established in Section 1061 is that carried interests must be held for three years rather than the normal one-year period to qualify for long-term capital gains treatment. Carried interest allows hedge funds to evade their tax obligations. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes.

Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021 202 PM EDT Christina Wilkie. Senator Tammy Baldwin D-WI and Representative Sander Levin D-MI today reintroduced tax reform legislation to close the carried interest loophole. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax.

The Proposal would repeal Section 1061 1 the three-year carry rule that was enacted as part of the 2017 tax reform legislation and instead subject the holder of a carried interest to current inclusions of compensation income taxable at ordinary income rates in amounts that purport to approximate the value of a deemed interest-free loan from the. Senators Sherrod Brown D-OH Tammy Baldwin D-WI and Joe Manchin D-WV introduced tax reform legislation to close the carried interest tax loophole that benefits wealthy money managers on Wall Street. Following the enactment of the 2017 Tax Reform practitioners considered the ability to use carry waivers as a possible technique to avoid the implications of Section 1061 and often incorporated such.

15 on partnership profits allocated to a carried interest while the same amount of compensation structured as a salary would be taxed at ordinary income rates as high as 358 Since a 2008 article by Professor Victor Fleischer questioned the current taxation of private equity carried interest9 the issue has been. Enacted as part of the 2017 Tax Cuts and Jobs Act Section 1061 was the first step taken to curtail the preferential treatment of carried interests. Olivier De Moor Patrick Fenn Lewis Kweit.

115-97 known as the Tax Cuts and Jobs Act extended the holding period with respect to certain carried interests applicable partnership interests to three years to be eligible for capital gain treatment. The Joint Committee on Taxation estimates that a carried interest tax increase will raise a paltry 196 billion in revenue over a decade with Tax Foundation estimating that this number would be just. The BBBA drops any base tax rate increases on individuals and.

No Change in Rates. NO BASE TAX RATE INCREASES NO CARRIED INTEREST REFORM. Tax reform is still making an impact on the way you do business.

A carried interest tax increase is also bad policy. Others argue that it is consistent with the tax treatment of other entrepreneurial income. Last week President Trump released a one-page tax reform outline full of tax breaks for the wealthiest Americans that did not include any reference to closing the carried interest.

The industry strongly opposed extending the holding period to three years as part of tax reform legislation enacted in 2017 but notes that final regulations released in January 2021 exclude Section 1231 gains from the. The top marginal federal income tax rate is currently 37 percent yet thanks to the carried interest loophole the income that private equity and venture capital managers get from their clients is. 3 Tax scholars and politicians have cited the preferential tax treatment of carried interest as a significant legal loophole.

Carried Interest Waivers. Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation. Congress has proposed to more than double the income tax on carried interestthe payout that fund managers receive when their investments are profitableto prevent fund managers from receiving a purported windfall.

The Tax Cuts And Jobs Act An Appraisal In Imf Working Papers Volume 2018 Issue 185 2018

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Remote Work Tax Reform Improving Tax Mobility And Tax Modernization

Tax Spillovers From Us Corporate Income Tax Reform In Imf Working Papers Volume 2018 Issue 166 2018

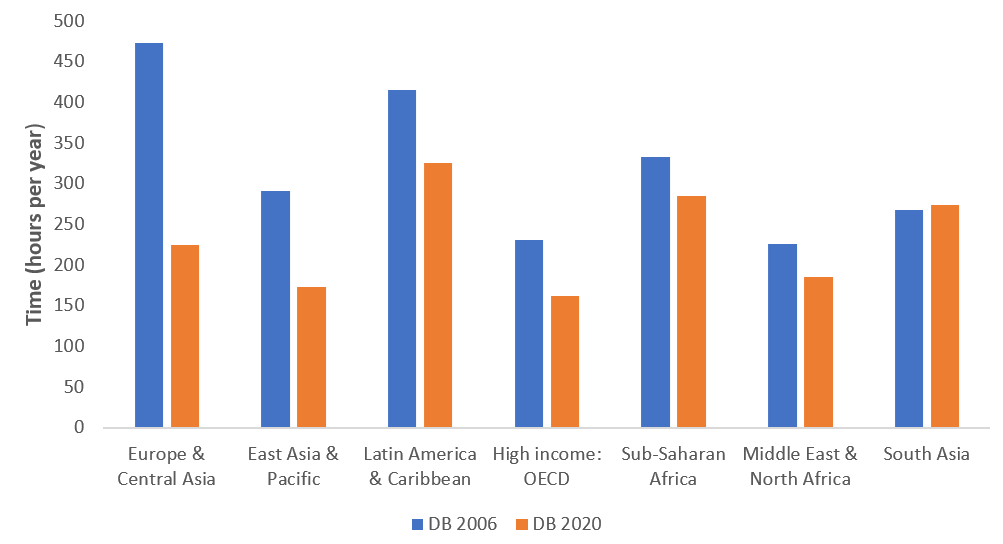

Paying Taxes Reforms Doing Business World Bank Group

Angels Angered As Lobbyists Shape Biden S Tax Reforms Financial Times

Get Your Business Gst Ready With Easy Online Accounting Software Accounting Accounting Services

What Are The Consequences Of The New Us International Tax System Tax Policy Center

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Tax Spillovers From Us Corporate Income Tax Reform In Imf Working Papers Volume 2018 Issue 166 2018

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Perspectives On The Progress Of Global Corporate Tax Reform Ictd

The Tax Cuts And Jobs Act An Appraisal In Imf Working Papers Volume 2018 Issue 185 2018

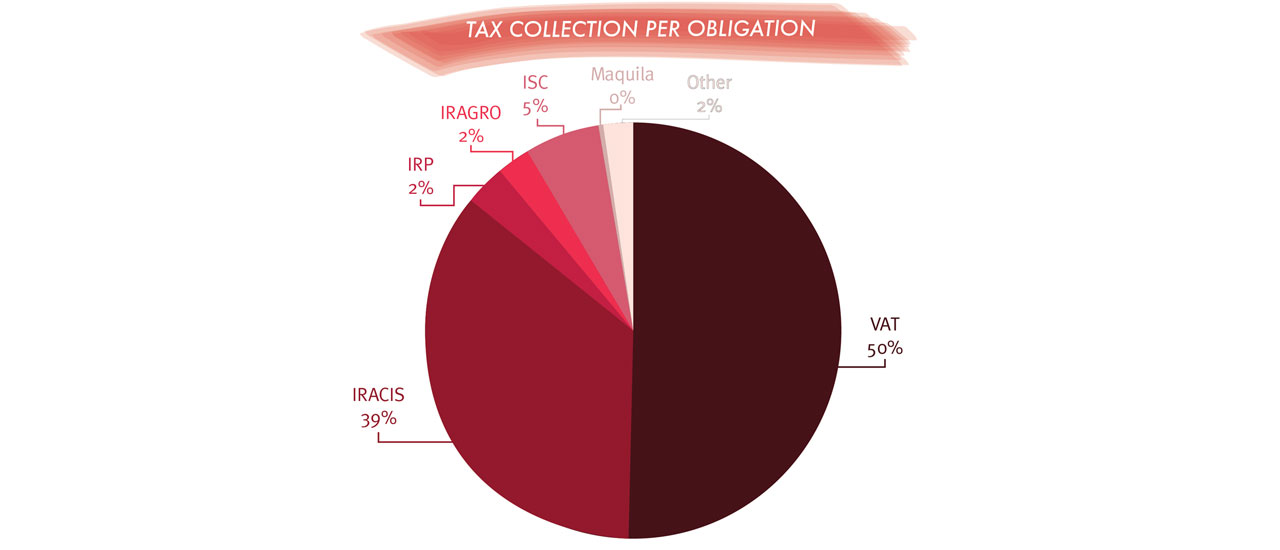

Modifications To The Tax System In Paraguay Ecovis International

Maldives In Imf Staff Country Reports Volume 2019 Issue 196 2019

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Tax Spillovers From Us Corporate Income Tax Reform In Imf Working Papers Volume 2018 Issue 166 2018